As we usher in the new year, let’s delve into the anticipated trends and dynamics that will shape the precious metals market. Doylestown Gold Exchange brings you a comprehensive overview, combining insights from NASDAQ and Bullion Exchanges in the 2024 precious metals market outlook.

Gold’s Prominent Position in 2024 Shining a Spotlight: The 2024 Precious Metals Market Outlook

Overview

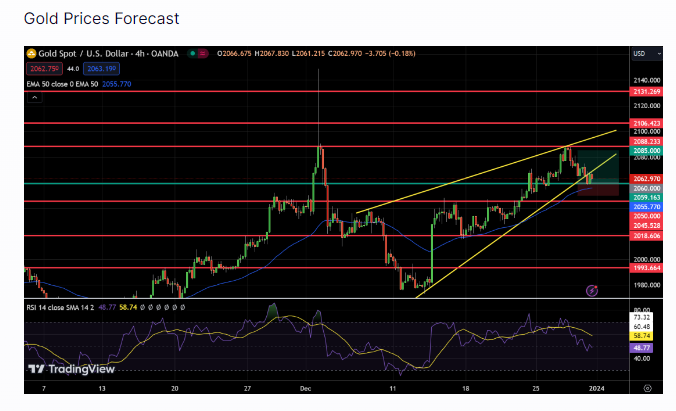

The NASDAQ predicts that gold is poised for record highs in 2024. Several factors contribute to this bullish outlook, including dovish U.S. rate shifts, geopolitical tensions, and central bank buying. In 2023 alone, spot gold witnessed a remarkable 13% increase.

Forecast

A peak of $2,300 per ounce is forecasted for mid-2024, signaling a robust market for gold enthusiasts. This projection underscores the metal’s enduring appeal as a safe-haven asset.

Influential Factors in Gold’s Outlook

Navigating Economic and Political Turbulence

- Economic Instability and Geopolitical Tensions: The global economy grapples with the aftermath of the COVID-19 pandemic, coupled with ongoing geopolitical tensions. In such uncertain times, gold often emerges as a stable investment, enhancing its allure for investors.

- Inflation and Government Policies: Persistent inflationary pressures, driven by increased government spending and disrupted supply chains, are expected to draw investors toward gold. As fiat currencies face devaluation risks, gold’s intrinsic value becomes more attractive.

- Central Bank Policies and Interest Rates: The decisions of major central banks, especially the Federal Reserve, will play a pivotal role. Interest rates and quantitative easing programs could significantly impact gold prices, with any indication of easing monetary policies bolstering gold’s appeal.

- Technological and Industrial Demand: Gold’s practical applications in electronics and green energy sectors are expected to sustain robust demand. The metal’s conductive properties make it indispensable in various high-tech industries, supporting its industrial demand.

Silver’s Multifaceted Outlook in 2024

Navigating Challenges and Opportunities

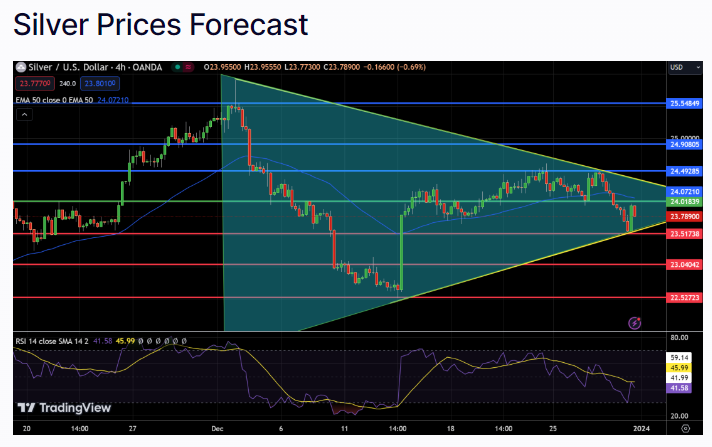

- Industrial Applications and Technological Advancements: Silver’s extensive use in electronics, solar panels, and medical applications underpins its industrial demand. Technological advancements and the expansion of the renewable energy sector are expected to bolster silver’s industrial usage.

- Green Energy and Environmental Policies: The global shift towards clean and renewable energy sources, such as solar power, is anticipated to significantly drive up the demand for silver. Its critical role in photovoltaic cells positions silver as a key player in the green energy movement.

- Investor Interest and Market Accessibility: Silver’s lower price point than gold makes it an accessible investment for a broader range of investors. Increased investment demand is expected as awareness and interest in precious metals grow, particularly in emerging markets.

- Market Volatility and Speculative Trading: Silver’s price volatility, compared to gold, makes it a target for speculative trading. This volatility presents both risks and opportunities for traders and investors, adding a layer of complexity to the silver market.

Navigating the Path Ahead with 2024 Precious Metals

As we step into 2024, the precious metals market promises an exciting journey for investors. Whether you’re drawn to the enduring appeal of gold or the multifaceted opportunities presented by silver, staying informed is key. At Doylestown Gold Exchange, we are your trusted partner in navigating the evolving landscape of precious metals. Contact us today for more information.