January 30, 2026 – Doylestown Gold Exchange – Due to historic volatility across the precious metals market, Doylestown Gold Exchange is encouraging customers to call or stop into the store to receive the most accurate and up-to-date information regarding current buying and selling practices.

Recent market conditions, particularly in the physical silver market, have created rapid price movements and shifting availability that can change day-to-day. Global demand for physical silver has increased sharply, while supply from refiners and wholesalers has tightened, resulting in pricing inconsistencies and limited inventory across the industry. These dynamics have been widely reported throughout the precious metals sector and are affecting dealers nationwide.

In response, Doylestown Gold Exchange is taking a thoughtful, customer-first approach. While purchasing activity for certain precious metals may be temporarily adjusted, the Exchange continues to actively serve customers and provide transparent guidance based on real-time market conditions.

At the same time, Doylestown Gold Exchange is currently offering some silver bullion at or below spot price, creating a unique opportunity for customers interested in acquiring physical silver during a period when premiums are elevated elsewhere in the market. Availability and pricing may vary based on market movement and inventory levels.

Silver markets have experienced extraordinary upheaval in recent months. Prices have surged sharply, driven by elevated investment demand, industrial consumption, and tight physical stock levels. As of late January 2026, silver prices have moved decisively above $100 per ounce in key trading centers — a level not seen in decades. This rally has been bolstered by strong retail demand for physical bars and coins, limited refinery throughput, and ongoing withdrawals from exchange inventories.

Physical bullion availability has also tightened materially. Major wholesalers and dealers across the United States report sell-outs of key silver products and, in some cases, are refraining from new orders as credit lines and refining capacity are stretched to limits. These dynamics have contributed to a disconnect between paper prices on futures exchanges and the actual supply and delivery of physical metal.

Doylestown Gold Exchange remains committed to fair pricing, education, and long-term customer relationships. The team continues to closely monitor market developments and will adjust practices as stability returns.

Doylestown Gold Exchange continues to monitor market developments closely. Customers are encouraged to contact the store directly for the most current information on buying, selling, and silver bullion availability.

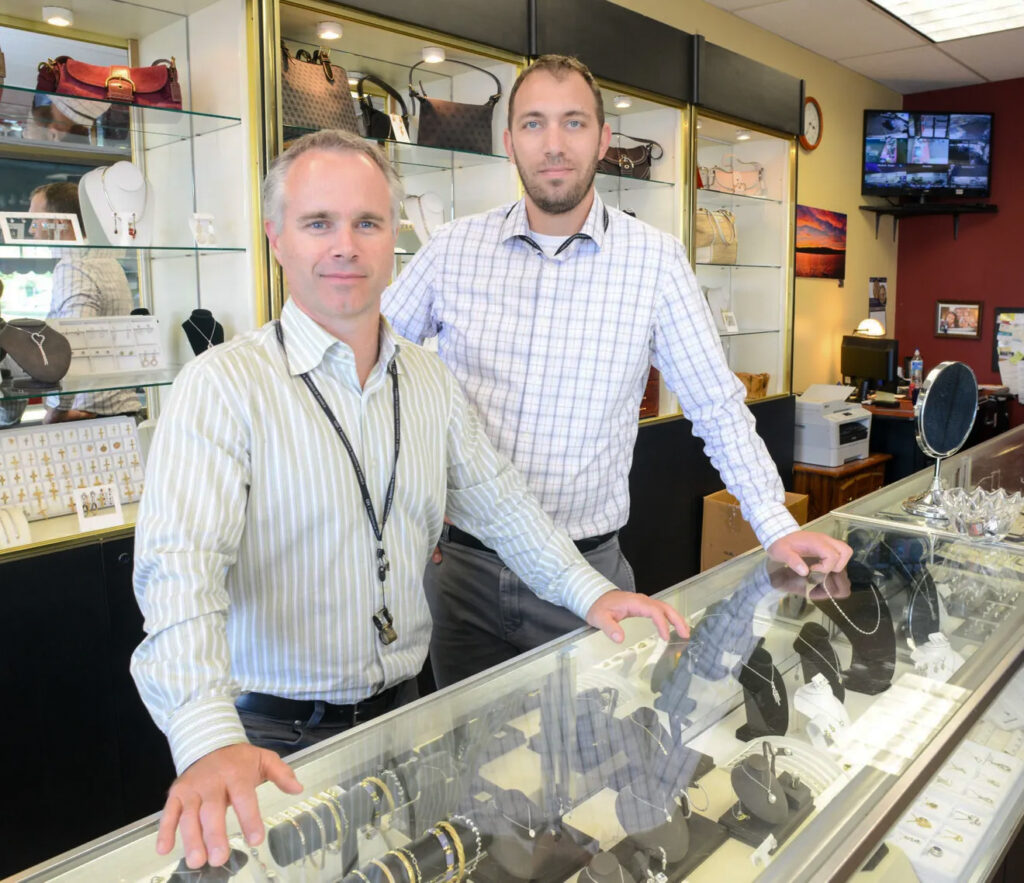

Who Is Doylestown Gold Exchange?

Doylestown Gold Exchange is a full-service precious metals dealer specializing in buying, selling, and trading gold, silver, platinum, and palladium bullion and numismatic products. With decades of industry experience and a commitment to fair pricing and transparent service, the company serves investors, collectors, and the general public from its Doylestown, Pennsylvania location.